Boosting financial literacy for Kiwi kids, with Rabobank

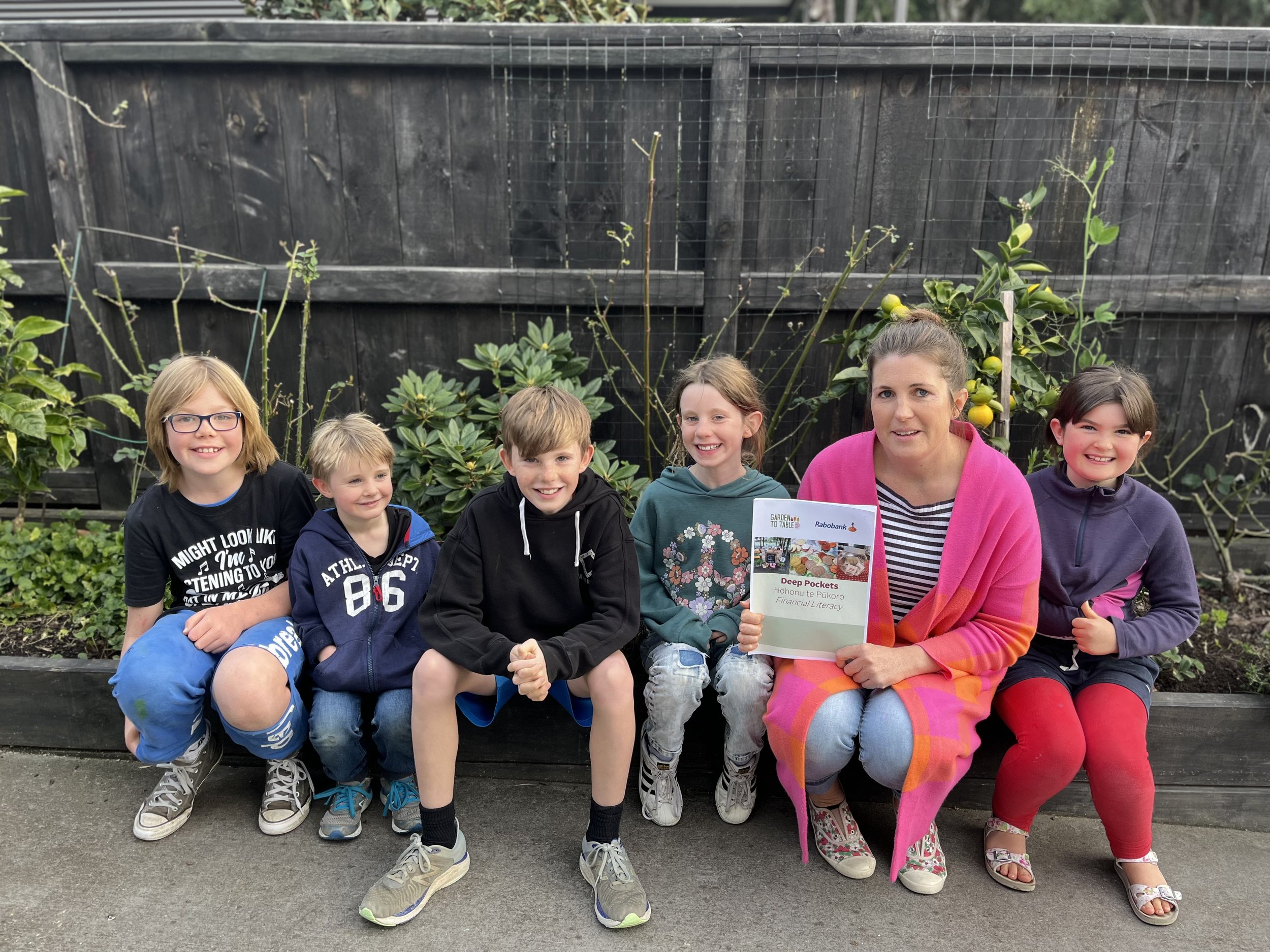

Rabobank and Garden to Table have launched a new teaching resource to develop and strengthen money management skills among New Zealand school children.

Deep Pockets, Hōhonu te Pūkoro outlines a ten-lesson teaching unit that helps students build their financial literacy skills by undertaking everyday garden and cooking activities.

Both Rabobank and Garden to Table are delighted to offer this members-only resource for free to every school or education provider in Aotearoa New Zealand that is interested in developing their students' financial literacy capabilities.

Rabobank New Zealand CEO Todd Charteris says the new teaching resource gives students the chance to handle real money and to make a real product to sell at a profit.

“The students get to make the financial decisions along the way and decide what to do with the profit they make.”

By the end of the unit, students will be able to complete a product plan, make and sell a product, write a basic financial report, understand how borrowing and investing money works, and be familiar with financial terms.

Garden to Table Curriculum and Community Relations Manager Victoria Bernard says making money is a real motivator for students.

“Having deep pockets is to have abundant financial resources – in other words, lots of money! In this unit, the students get to make all the financial decisions along the way and they decide what to do with the profit they make – will they reinvest it and try to make even more money?”

Victoria says the unit is best suited to students in Year 3 and above. However, some parts of it could be introduced to students in Years 1-2 (or to those at an early childhood level).

“Generally, these types of resources are only made available to our Garden to Table schools. But, with Rabobank’s support, we are really keen to make it more widely available to all primary, intermediate, and secondary schools around the motu – and to anyone else who might be interested.”

Victoria says “The current cost-of-living crisis – and especially the significant increase in food prices – reinforces our view that this type of resource is necessary.”

“It’s also fantastic to have it ready just in time for term three and for NZ Money Month which kicks off in August.”

The Financial Literacy resource gives ākonga (students) a lot of responsibility and the chance to take on roles like project manager, risk manager or marketing manager.

Victoria says “This helps students identify who might be best suited to certain roles and how they can work together as a team to get the mahi done, and it’s all done in a low-risk context with guidance from their teacher.”

“Schools already involved in Garden to Table got a heads-up that the resource was coming. They’re planning to start the unit in August and run it through term three. However, the unit can be run at any time during the year.”

Ngā mihi nui, Rabobank – Thank you for helping us create this Financial Literacy resource and for enabling it to be widely shared.

Read Rabobank’s press release on this resource.

Listen to Victoria’s interview with Jamie Mackay on The Country radio programme.

Garden to Table provides member schools with a wide range of curriculum linked material. We also provide support, ongoing training, and access to hundreds of recipes, resources, and lesson plans. Join up your school or ask for more information here.